It seems obvious to say that a loyal group of high-spend, VIP gamblers are extremely important for a casino's success. No surprise there. But many executives continue to under-estimate the size of the VIP group's contribution to overall casino revenue. In doing so, they fail to prepare a marketing strategy, game inventory, and operational procedures that sufficiently cater to the most valuable segment.

The "Pareto Principle," or more commonly, the "80/20 Rule," states that for many companies, 80% of revenue comes from a small group, around 20%, of the customer base. At many casinos, however, the distribution is skewed even more heavily in favor of the top players. Ratios like 80/8 and 90/15 are not uncommon -- i.e. just 8% (not 20%) of your customer base may contribute 80% of revenue, or 15% of customers contribute 90%.

The graphs below track conribution percentages across years at a Native American resort, divided into slots vs tables and actual vs theo. The lighter pink line represents the 80% threshold, and it never gets near 20% in any year or measurement. The 90% line (darker) stayed below 15% most of the time. On the more extreme side, when it comes to actual table game revenue, 90% of total win came from just 5% of players.

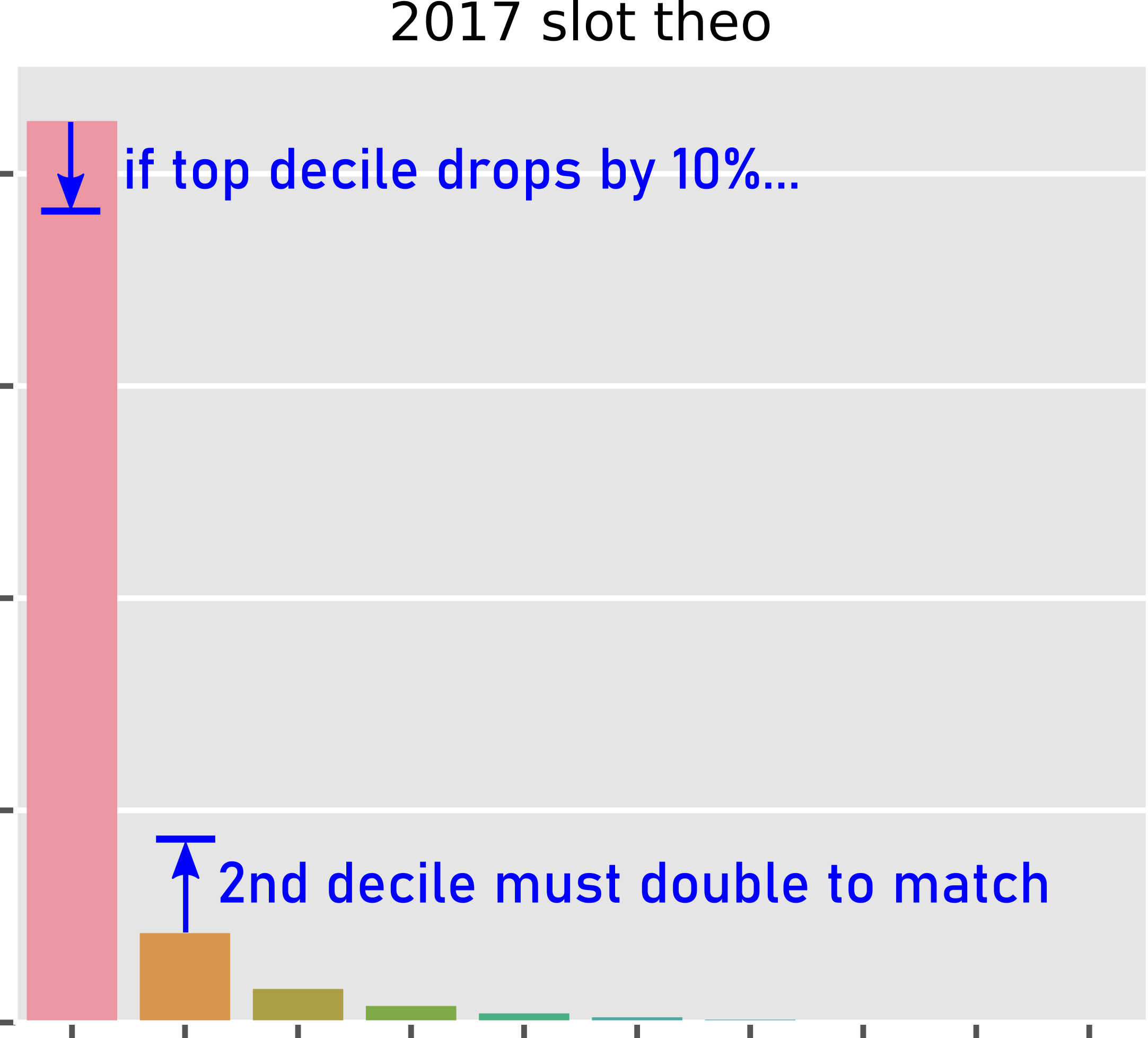

Another way of looking at the same thing is to divide the customers into deciles (10 groups) and display each group's contributions. This view emphasizes the extent to which that top decile -- the top 10% of your customers -- dominate the other 90%. The bottom half of players are non-measurable, their conribution is so tiny.

Consider the implications on marketing. Is your team spending 80% or 90% of its time, effort, budget on VIP customers? Most likely, the majority of marketing's time is spent creating and developing mass-market promotions and giveaways.

Of course, having a loyal group of top-tier players is great. But it comes with responsibility. In order for your casino to remain successful and grow revenue, this group of players must be developed, nurtered and catered to. If this group experiences a decline in visitation or spend, it's highly unlikely that any other segment can grow enough to offset the losses. Think about it, if the first decile declines by 10%, the 2nd decile would need to double to make up that gap.

The year-by-year graphs appear to demonstrate stability among the VIP players' contributions. While this is reasonably true in aggregate, individually, many of these VIPs are highly volatile. That's the illusion that many marketing executives fail to fully appreciate, that the composition of the VIP group is constantly in flux. There are new players whose spend is growing, moving up into the top decile, but others are reducing play and falling out of the group. In fact, few players are stable and consistent at very high levels of spend. And while keeping these players loyal is a challenge, it's also, often, an untapped opportunity.

Continue to Part 2